child tax credit 2021 portal

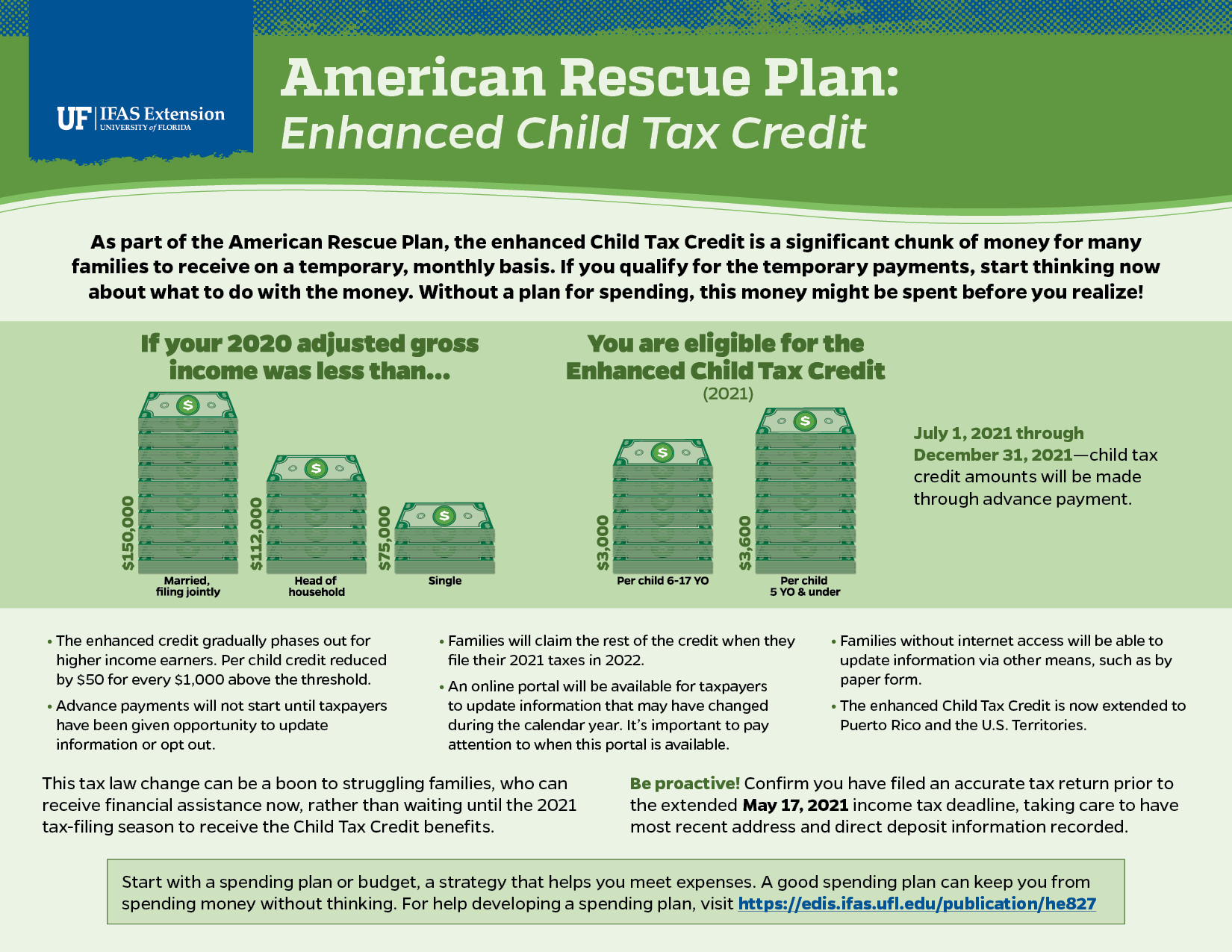

That total changes to 3000 for each child ages six through 17. If you already filed your taxes for 2020 and are.

Irs Child Tax Credit Is The Web Portal The Best Way To Apply What Other Options Do I Have As Usa

For 2021 eligible parents or guardians can receive up to 3600 for each child who.

. The Child Tax Credit Update Portal allows families to update direct deposit information or unenroll. The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children. The Child Tax Credit provides money to support American families.

COVID Tax Tip 2021-101 July 14 2021. Get your advance payments total and number of qualifying children in your online account. The expanded Child Tax Credit CTC for 2021 was a part of the American Rescue Plan Act ARPA signed into law by President Biden to get pandemic cash assistance to more families.

To get money to families sooner the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the ages of 6 and. You can use your username and password for the. Half of the money will come as six monthly payments and half as a 2021 tax credit.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. The Child Tax Credit is a credit that helps with the cost of raising a child.

First families should use the Child Tax Credit Update Portal to. Important changes to the Child Tax Credit will help many families. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021.

3600 for children ages 5 and under at the end of 2021. The IRS will make a one-time. The IRS pre-paid half the total credit amount in monthly payments from.

Individual Income Tax Attorney Occupational Tax Unified Gift and. IMPORTANT INFORMATION - the following tax types are now available in myconneCT. 3000 for children ages.

The new Child Tax Credit Update Portal allows parents to view their eligibility view their expected CTC advance payments and if they wish to do so unenroll from receiving. If you received any monthly Advance Child Tax Credit payments in 2021 you need to file. Department of Revenue Services.

Here is some important information to understand about this years Child Tax Credit. The credit is worth up to 2000 per qualifying child. I think its because I filed an.

2021 Tax Filing Information. If you have at least one qualifying child and earned less than 24800 as a married couple 18650 as a Head of Household or 12400 as a single filer you can use the Code for America. 2021 Tax Filing Information Get your advance payments total and number of.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. The Child Tax Credit program can reduce the Federal tax you owe by 1000 for each qualifying child under the age of 17. Similarly for each child age 6 to 16 its increased from 2000 to 3000.

Under the American Rescue Plan the IRS disbursed. It also provides the 3000 credit for 17-year-olds. The IRS recently upgraded the.

The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per child age 6-17.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Training Becoming A Ctc Navigator And Non Filer Ctc Update Portals Walk Through Get It Back

American Rescue Plan Enhanced Child Tax Credit Living Well In The Panhandle

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Breaking News The Child Tax Credit Portal Is Open Your Money Line

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

White House Unveils Updated Child Tax Credit Portal For Eligible Families

Child Tax Credit Portal Now Open For Non Filers How To Claim Up To 3 600 The Us Sun

I Got My Refund Https Www Irs Gov Newsroom Irs Updates 2021 Child Tax Credit And Advance Child Tax Credit Payments Frequently Asked Questions Facebook

Child Tax Credit Irs To Open Portals On July 1 Checks Will Begin July 15 Where S My Refund Tax News Information

2021 Advance Child Tax Credit Payments

Child Tax Credit 2021 Update Parents Can Use Irs Portal To See Where Their 300 Is And Opt Out Of Payments The Us Sun

Get Set To Get Your Monthly Child Tax Credits By Clare Herceg Let S Get Set Medium

Child Tax Credit Update Portal 2021 2022

Child Tax Credit Portal Update New Non Filer Sign Up Tool 2021

New 3 600 Child Tax Credit Portal How To Unenroll From Child Tax Credit 2021 Youtube

Change Address On Child Tax Credit Update Portal Winkelman Bruce Truax Llp